How to Buy a Property in Dubai? [2026 Buying Guide]

Buying property in Dubai in 2026 is easier, faster, and safer than ever before. The city continues to attract investors and residents from all over the world, thanks to its strong economy, tax-free environment, and transparent legal framework.

If you are looking to invest, relocate, or buy your first property, understanding how to buy property in Dubai will save you time, money, and unnecessary stress.

This step-by-step guide by Parklane Homes will walk you through everything from Dubai’s property laws and ownership rules to fees, financing, and final registration.

Can Foreigners Buy Property in Dubai? Updated 2025 Laws

Yes, foreigners can legally buy, own, and sell properties in Dubai. The property market is open to international investors under Law No. 7 of 2006, which allows non-UAE nationals to purchase properties in specific freehold zones.

These freehold areas are approved by the Dubai Land Department (DLD) and include some of the city’s most popular communities such as:

- Dubai Marina

- Downtown Dubai

- Business Bay

- Jumeirah Village Circle (JVC)

- Palm Jumeirah

- Dubai Hills Estate

- Arabian Ranches

Foreigners are not required to have UAE residency to purchase property. Both residents and non-residents can buy apartments, villas, or townhouses within designated freehold areas. Ownership is permanent and includes full rights to sell, lease, or pass on the property to heirs.

Freehold vs Leasehold: What You Should Know

Before purchasing, it’s important to understand the two main types of ownership in Dubai.

| Feature | Freehold Ownership | Leasehold Ownership |

| Ownership Duration | Unlimited | Typically 30–99 years |

| Ownership Rights | Full property and land ownership | Right to occupy, rent, or use for the lease period |

| Suitable For | Investors, end-users, long-term holders | Tenants, short-term investors |

| Typical Areas | Downtown, JVC, Business Bay, Marina | Older districts like Deira, Jumeirah (limited cases) |

| Resale & Inheritance | Allowed without restriction | Subject to lease terms |

Freehold ownership gives you full control of the property, while leasehold grants long-term rights for a specific period. For most international buyers, freehold is the preferred option.

Step-by-Step Property Buying Process in Dubai (2026)

Let’s break down the entire process so you can move forward confidently and avoid costly mistakes.

Step 1: Define Your Goal and Budget

Start by clarifying your purpose. Are you buying to live, invest, or rent out? Your goal will help determine the right community and property type.

Set a realistic budget. Apart from the property price, consider additional costs like:

- Dubai Land Department (DLD) transfer fee (4%)

- Real estate agent commission (normally it depends, but it’s around 2%)

- Developer No Objection Certificate (NOC) fees

- Service charges and maintenance fees

- Trustee office and registration costs

A clear budget will keep your search focused and help you negotiate better.

Step 2: Choose Financing: Cash or Mortgage

You can purchase property in Dubai using either cash or mortgage financing.

Cash Buyers

- Enjoy faster transactions

- Often secure better deals

- Avoid bank approval delays

Mortgage Buyers

If you are a resident or foreign investor, you can get mortgage approval through UAE banks, subject to eligibility.

Typical conditions include:

- Down payment: 20% for UAE residents, 25% for non-residents

- Mortgage registration fee: 0.25% of the loan amount (payable to DLD)

- Bank valuation fee: AED 2,500–3,500

- Income requirement: steady proof of salary or business income

Mortgage pre-approval takes about one to two weeks. Having it ready strengthens your negotiation power when you find the right property.

Step 3: Select a Freehold Area and Property Type

Now it’s time to choose where and what to buy. Dubai offers both ready-to-move in and off-plan properties.

Ready-to-Move Properties

Perfect for buyers who want immediate occupancy or quick rental income. These properties are fully built and registered with DLD. Browse top communities via Ready To Move in Properties in Dubai.

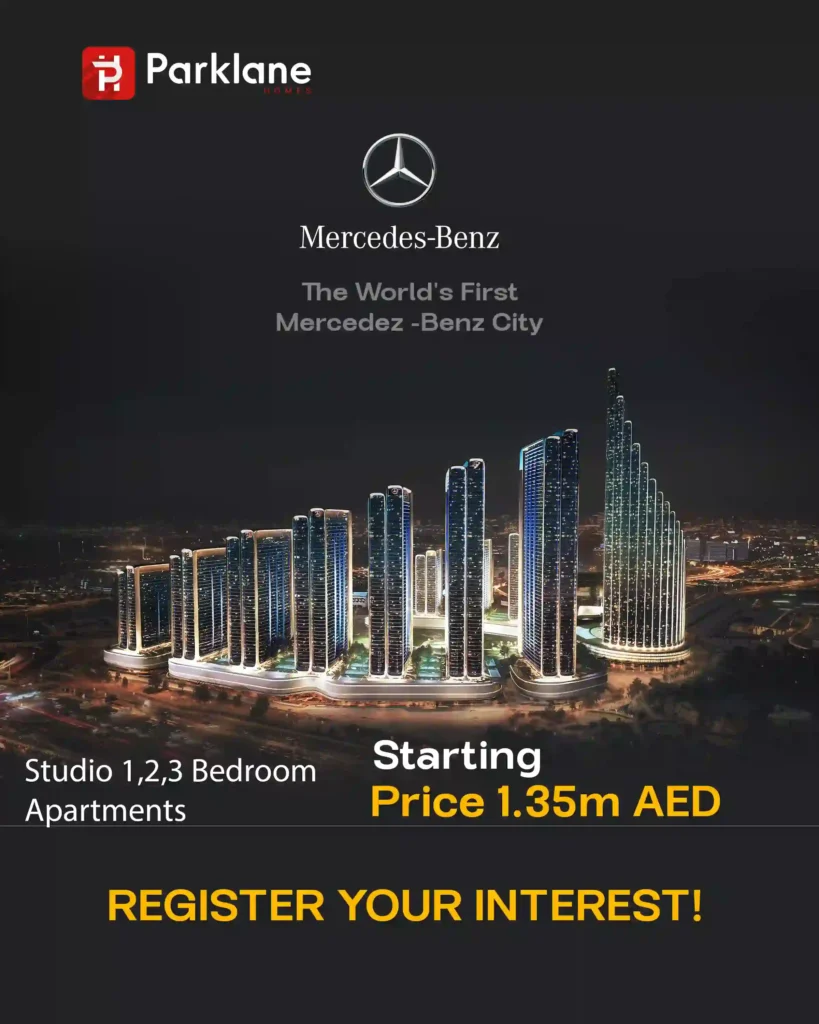

Off-Plan Properties

Ideal for investors seeking lower entry prices and flexible payment schedules. However, you must ensure the project is registered with RERA, and the developer has a solid track record. For verified developments, see Upcoming Off Plan Projects in Dubai.

When choosing a location, consider:

- Proximity to key areas (workplaces, schools, metro)

- Community amenities and developer reputation

- Expected ROI (rental yield in Marina: 6–7%, JVC: 7–8%)

Step 4: Conduct Due Diligence and Verify the Property

Always verify property ownership, developer registration, and project status.

For ready properties:

- Confirm the seller’s name matches the title deed.

- Ensure there are no unpaid service charges or outstanding loans.

For off-plan properties:

- Check the project’s RERA registration and escrow account.

- Review payment schedules and expected completion date.

It’s wise to work with a licensed agent or agency familiar with Dubai’s property laws. They can handle verification through official DLD and RERA channels.

Step 5: Sign the Sale Agreement (Form F or MOU)

Once you have agreed on the price, terms, and payment structure, you will sign the Form F (Memorandum of Understanding).

This document is registered with the Dubai Land Department and outlines the responsibilities of both buyer and seller, including:

- Final agreed price

- Payment terms

- Transfer timeline

- Penalties for breach

Both parties sign it at a DLD-approved trustee office. The buyer usually provides a 10% deposit, held as security until the transfer is completed.

Step 6: Obtain a No Objection Certificate (NOC)

For resale or secondary properties, the developer issues an NOC confirming that all service charges are paid.

The buyer, seller, and agent typically meet at the developer’s office to apply for the NOC. Typical NOC fees range between AED 500–5,000, depending on the developer.

Developers like Emaar and Nakheel issue NOCs within a few days once payments are cleared. Keep this document ready for the next step.

Step 7: Transfer Ownership at the Dubai Land Department

Once the NOC is ready, both parties visit a DLD Trustee Office to finalize the transfer.

You’ll need:

- Original Form F (MOU)

- NOC from the developer

- Emirates ID or passport (for all parties)

- Manager’s cheque for the final payment made to the seller

At the time of transfer, you must also pay:

- DLD Transfer Fee: 4% of the property price

- Admin fee: AED 540–580 (depending on property type)

- Trustee office fee: AED 2,000–4,000

After verification, the buyer receives a Title Deed, making them the official property owner.

Step 8: Post-Purchase Checklist

Once you receive the title deed, complete the following:

- Register your property with DEWA (electricity and water connection)

- Pay any move-in or community service fees

- Update ownership records with the building management

- If it’s an investment property, list it for rent or property management

If you purchased off-plan, track the project’s completion and perform a snag inspection at handover.

Cost Breakdown: Total Fees When Buying Property in Dubai (2025)

Here’s what you should expect to pay beyond the property price:

| Fee Type | Amount / Percentage | Notes |

| DLD Transfer Fee | 4% of property value | Mandatory for all purchases |

| DLD Admin Fee | AED 540–580 | Varies by property type |

| Trustee Office Fee | AED 2,000–4,000 | Paid during ownership transfer |

| Real Estate Agent Commission | ~2% of property value ( Depends on brokerage and agent ) | Negotiable |

| NOC Fee | AED 500–5,000 | Charged by the developer for resale |

| Mortgage Registration | 0.25% of loan + AED 290 admin | For financed purchases |

| Property Valuation Fee | AED 2,500–3,500 | For mortgage buyers |

| Title Deed Issuance | AED 250 | One-time DLD fee |

| Annual Service Charges | AED 10–25 per sq.ft. | Based on community and property size |

Example Calculation:

For a property worth AED 2,000,000, expect total additional costs of approximately AED 80,000–100,000, excluding optional expenses such as furnishing or maintenance.

Buying Off-Plan Property in Dubai: Advantages and Risks

Off-plan property means buying directly from the developer before construction finishes. This remains a popular choice for investors in 2026.

Advantages:

- Lower prices and smaller initial payments

- Flexible payment plans (e.g., 60/40, 70/30 or 80/20)

- Strong capital appreciation upon completion

- Modern layouts and energy-efficient designs

Risks:

- Potential project delays

- Market fluctuations during construction

- Limited resale opportunities before handover

To stay safe:

- Buy only from RERA-approved developers

- Ensure all payments go into the official escrow account

- Request Oqood registration (developer submits your contract to DLD for tracking)

Golden Visa for Property Buyers

Dubai’s Golden Visa program allows investors who buy properties worth AED 2 million or more to qualify for long-term residency.

Eligibility:

- Property must be purchased with full payment (not under mortgage for the required value)

- Can include one or more properties totalling AED 2 million

- Valid for 5 or 10 years, depending on ownership

Benefits include:

- Residency for you and your family

- No employer sponsorship required

- Renewable as long as you retain ownership

This is a strong incentive for foreign buyers seeking both investment and lifestyle benefits in Dubai.

Common Mistakes Buyers Make (and How to Avoid Them)

Even experienced investors can make costly errors. Avoid these common mistakes:

- Not verifying ownership or developer status: Always check the developer’s RERA registration and project status.

- Skipping due diligence: Review all contracts, NOC, and payment schedules carefully.

- Ignoring hidden costs: Include DLD fees, maintenance, and NOC fees in your budget.

- Rushing without pre-approval: Secure mortgage pre-approval or cash availability before making offers.

- Dealing with unlicensed agents: Always verify the agent’s RERA ID.

Post-Purchase Costs and Considerations

After purchasing property, there are some recurring costs to keep in mind:

- Service charges: Paid annually to maintain community facilities.

- DEWA setup fees: Around AED 2,000, depending on property size.

- Maintenance and insurance: Especially for villas and independent homes.

- Leasing costs: If renting out your property, expect agency and advertising fees.

Owning property in Dubai is relatively low-maintenance, but proper planning ensures you avoid surprises later.

Why Work with Parklane Homes Real Estate?

At Parklane Homes, we simplify every step of buying property in Dubai. Our team helps you:

- Find verified freehold and off-plan properties

- Understand the full cost breakdown

- Compare communities and ROI potential

- Navigate documentation, legal checks, and DLD registration

Whether you want to invest, relocate, or secure your family’s future, our consultants provide transparent advice tailored to your goals.

Start your journey with confidence and explore the latest listings at Buy Property In Dubai.

FAQs About Buying Property in Dubai (2026)

1. Can foreigners buy property in Dubai?

Yes, foreigners can purchase freehold property in designated zones across Dubai under Law No. 7 of 2006.

2. How long does the process take?

Typically between 2–8 weeks, depending on whether the property is ready or off-plan.

3. What are the main fees involved?

Expect around 7–8% of the property price in total costs, including DLD, agent, and admin fees.

4. Do I need a residency visa to buy?

No. Both residents and non-residents can invest in Dubai’s freehold areas.

5. Can I get a mortgage as a non-resident?

Yes, most UAE banks provide financing to foreign buyers with a minimum down payment of 25%.

6. What is a Title Deed?

A legal document from the Dubai Land Department proving property ownership.

7. What is Form F?

Also called the Memorandum of Understanding (MOU), it’s the official agreement outlining sale terms between buyer and seller.

8. What is an NOC?

A document from the developer confirming no outstanding fees before ownership transfer.

9. What are service charges?

Annual fees paid for community maintenance, security, and shared facilities.

10. Can property ownership lead to a Golden Visa?

Yes, if your property value is AED 2 million or higher, you can qualify for Dubai’s Golden Visa program.

Final Thoughts

Buying property in Dubai is a straightforward process once you understand the rules, laws, and costs involved. With the right preparation and expert guidance, your investment can provide both financial returns and a world-class lifestyle.

Dubai’s real estate market in 2025 continues to grow steadily, supported by strong infrastructure, investor protection, and tax-free incentives.

If you’re ready to start your journey, reach out to Parklane Homes, your trusted partner for seamless property investment in Dubai.