How to buy off plan property in Dubai? Step by step process

Investing early in a development can be a smart move but navigating how to buy off plan property in Dubai requires a clear roadmap. With the right guidance you can secure a modern home or investment asset, manage your payments, and protect your rights. This guide takes you through the full off plan property buying process, from goal-setting through handover, so you know exactly what to expect.

Define Your Strategy and Budget

Start by asking why you’re buying: Are you looking for long-term capital growth, rental income, or a home to live in? Your purpose will shape every decision that follows. Next, set a realistic budget that covers not just the purchase price but also booking fees, registration costs, and service charges.

As you plan, it’s useful to check current properties to buy in Dubai to have an idea of pricing and availability.

Choose the Right Developer and Project

Selecting a registered, reliable developer and a strong location is crucial. Ensure the project is approved by the Real Estate Regulatory Agency (RERA) and the Dubai Land Department (DLD), and verify the developer’s previous delivery record and quality.

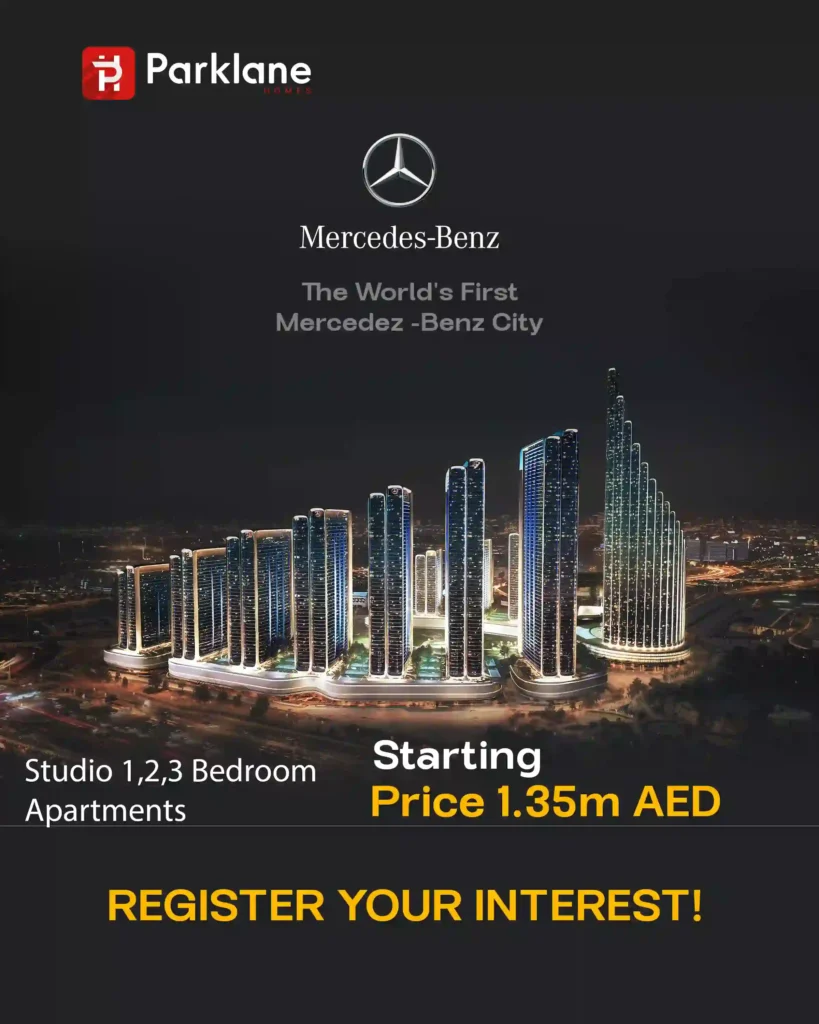

You can also Explore the latest off plan projects in Dubai to compare features, community set-up, payment plans and timing. Location, branding and community amenities all influence long-term value and rental potential.

The Buying Process Explained

Step 1: Understand the Legal and Payment Structure

The first major step in the buying off plan property in Dubai is to understand how the payment plan works and how you’re protected legally. Dubai law requires all off-plan sales to go through a RERA-approved escrow account and for the project to be registered via Oqood with DLD.

Step 2: Reserve Your Unit and Sign the SPA (Sales & Purchase Agreement)

Once you’ve chosen the unit, you pay the booking deposit and sign the SPA, which sets out all the terms, payment milestones, handover date and penalties. It’s also the time to align with your strategy and investment plan. For deep investment insights, consider reading guides for Off Plan Property Investments to understand returns and structure.

Step 3: Monitor the Construction Phase

During construction you will make periodic payments as per the milestone schedule. Developers are required to provide updates and log progress through RERA. Regularly track construction, review quality, and stay updated on milestone completion.

Step 4: Handover, Final Payment & Title Deed Registration

When construction finishes, the developer will issue a handover notice. You’ll do a final inspection, settle outstanding payments, and register your property with DLD. After registration you will receive your title deed, confirming your ownership

Step 5: Move In or Lease Your Property

Once you have the keys, you decide whether to move in or rent out. If you choose leasing, check service charges, community rules, and tenancy registration. If living in, implement maintenance plans and review community governance. Good post-handover management supports long-term value.

Why Off-Plan Properties Are a Smart Investment in Dubai

Off-plan properties offer lower entry prices, flexible payment plans, and the opportunity to benefit from capital appreciation once the project is completed. Many projects also align with residency benefits and long term Golden visa options. However, remember to assess market timing, delivery history, and community infrastructure, these differentiate successful projects from underperforming ones

How Parklane Homes Can Help You

If you’re ready to explore off-plan investment opportunities or luxurious future properties, As a trusted Real Estate agency in Business Bay, Parklane Homes is here to guide you. We’ll help you shortlist units, review contracts, and support the process until handover and beyond. Make your next move with confidence today.

FAQs

1. What protections do I have when buying off-plan?

The developer must operate a RERA-approved escrow account and register the project with DLD’s Oqood system, providing a strong legal framework for buyer protection.

2. How much do I need to pay up front?

Typically you pay a booking deposit of 5–10% when reserving, followed by milestone payments over construction and the final payment at handover.

3. Can foreigners buy off-plan in Dubai?

Yes. Foreign investors can buy off-plan in designated freehold zones provided requirements such as KYC and escrow funds are met.

4. What happens if the project is delayed?

The SPA should include clauses for delays and penalties. Delayed handovers happen but your rights are protected under RERA regulation and the escrow system.

5. Is off-plan always better than ready property?

Not always. Off-plan offers early-bird pricing and payment flexibility but comes with construction risk and timeline uncertainty. Existing properties may offer immediate occupancy and clearer returns. Choose based on your goal, risk appetite and timing.