Off Plan Property Investments in Dubai: 2025 Ultimate Guide

Investing in off-plan properties in Dubai allows you to enter the market at lower pre-construction prices with flexible payment plans and high potential returns. This makes Dubai off-plan real estate highly attractive for both local and overseas investors seeking long-term capital growth.

Dubai offers high rental yields, consistent capital appreciation, and a transparent regulatory environment governed by the Dubai Land Department (DLD) and the Real Estate Regulatory Authority (RERA). These factors create a safe and lucrative investment ecosystem, especially for first-time buyers or international investors looking to diversify their portfolio.

Dubai’s strategic location, world-class infrastructure, and continuous development make it a hotspot for property investments that promise both lifestyle and financial benefits.

What is Off-Plan Property Investment?

Off-plan property refers to a property sold before construction is completed, offering early investment advantages and potential price appreciation. Investors can enter the market at a lower cost compared to ready properties, often benefiting from capital gains once the project is delivered.

Types of off-plan properties:

- Apartments

- Villas

- Townhouses

Compared with ready properties, off-plan investments provide:

- Lower upfront costs

- Customization options

- High ROI potential

- Gateway to Dubai golden visa

According to Dubai Land Department data, off-plan properties accounted for a significant share of Dubai’s real estate market, with an estimated AED 300 billion in transactions in 2024–25.

Why Invest in Off-Plan Properties in Dubai

Off-plan properties provide affordability, high ROI potential, and flexible payment options that make them highly appealing.

Advantages include:

- Lower Pre-Construction Prices: Secure a property at an early stage at a discounted rate

- Customization Options: Personalize finishes and layouts to your preferences

- Developer Incentives: Early buyers often receive attractive offers and bonuses

- Capital Appreciation Potential: Property values typically increase during construction

Risk considerations:

Construction delays and developer reliability are key factors to assess before investing. Conducting due diligence and choosing reputable developers mitigates these risks.

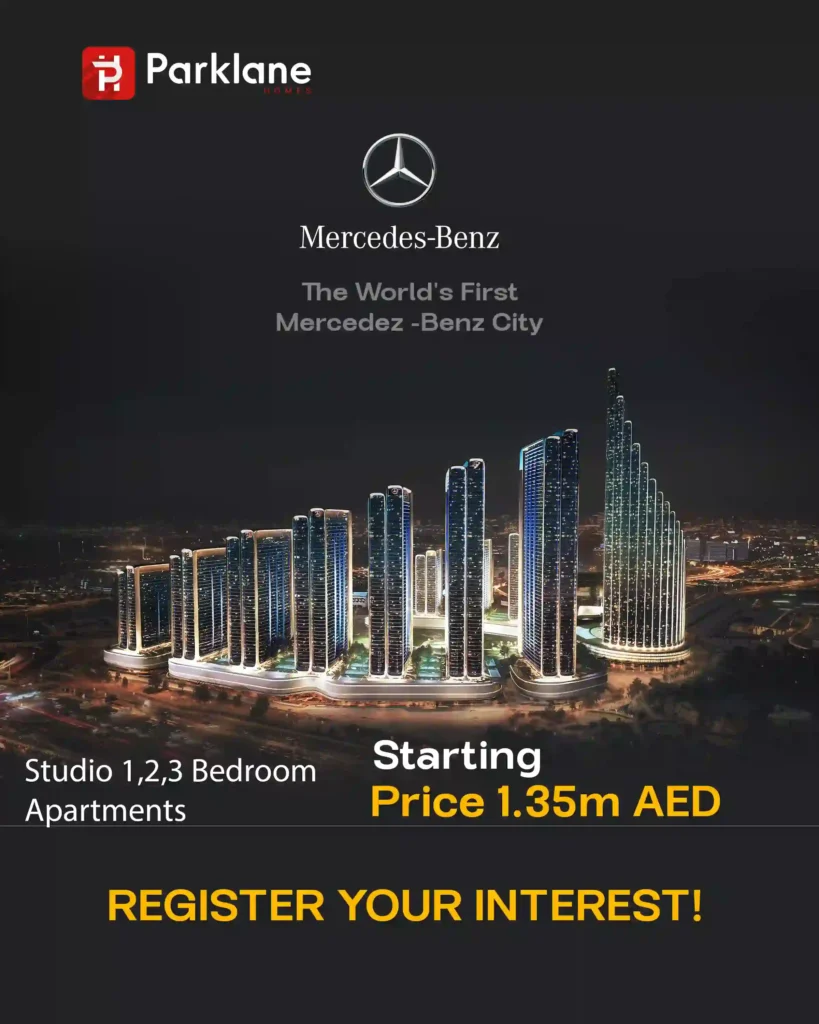

Top Off-Plan Property Investment Opportunities in Dubai (2025)

Key communities provide prime investment potential for both first-time buyers and seasoned investors.

Featured Communities:

- Nakheel Palm Jebel Ali: Luxury waterfront apartments and villas with strong rental demand,

- Emaar Grand Polo & Oasis: Family-friendly, modern amenities, strong capital appreciation,

- Dubai Island: Exclusive island properties with high ROI potential,

- Mina Rashid: Mixed-use community offering premium waterfront development,

- Maritime City: Strategic coastal location, attractive for maritime lifestyle investors,

Investors should consider rental demand, community amenities, and developer track record before committing to any off-plan project.

How to Buy Off-Plan Property in Dubai

Buying off-plan requires careful planning, research on developers, understanding payment plans, and legal compliance.

Research the Developer

- Check past project quality and delivery track record

- Gather investor feedback and testimonials

- Verify developer registration and approvals

Understand Payment Plans

- Typical 20–80% structure: small initial deposit, milestone-based installments, final payment on handover

- Flexible payment plans reduce financial pressure

Legal Protection & RERA Guidelines

- Use escrow accounts to protect funds

- Ensure project approvals are verified by RERA

- Register the Sales Purchase Agreement (SPA) with Dubai Land Department

Property Inspection & Market Trends

- Review floor plans and virtual tours

- Study market performance and rental yields

- Compare amenities with similar communities

Financial Considerations for Off-Plan Investments

Assessing financial readiness, ROI potential, and long-term plans is crucial before investing in off-plan properties.

Budget Planning & Installments

- Initial deposit followed by milestone-based payments

- Include Dubai Land Department (DLD) registration fees

- Plan cash flow to avoid overextension

ROI & Capital Appreciation

- Expected rental yields: 7–9% annually

- Capital appreciation through market growth and property development

- Resale potential in high-demand communities

Market Timing & Risk Mitigation

- Consider economic cycles and construction timelines.

- Assess developer reliability

- Diversify investments across multiple communities

Why Choose Parklane Homes for Off-Plan Investments

Parklane Homes provides expert guidance, exclusive access to top off-plan projects, and tailored investment solutions.

Trusted Brokerage & Market Expertise

- Over a decade in off-plan property investments

- Recognized for reliability and transparency

Exclusive Access to Prime Communities

- Palm Jebel Ali, Emaar Grand Polo & Oasis, Dubai Island, Mina Rashid, Maritime City

Personalized Investment Guidance

- Services for first-time buyers, overseas investors, and high-net-worth clients

Market Insights & Analytics

- Real-time data on property performance, trends, and developer reputation

Flexible Solutions & ROI Maximization

- Assistance with payment plans, risk assessment, and capital growth strategies

For more information, explore Parklane Homes Off-Plan Listings

Steps to Secure Your Off-Plan Property Investment

- Select a reputable developer and community

- Review payment plans and financial feasibility

- Sign SPA and register with Dubai Land Department

- Monitor construction progress and milestone payments

- Take possession and explore ROI options (rent/sell)

Examples of active off-plan projects: Palm Jebel Ali, Mina Rashid

FAQs

What is off-plan property investment in Dubai?

Off-plan investment simply means buying a property before it’s completed. It’s a smart way to get in at lower prices, enjoy flexible payment options, and benefit from potential capital gains once the project is finished.

How is buying off-plan different from ready properties?

The main difference is timing and cost. With off-plan, you can enter early at a discounted price and even customize your property, whereas ready properties usually require full upfront payment and are ready to move in.

What is the typical ROI for Dubai off-plan projects?

Dubai’s off-plan properties often give rental yields between 7–9%, plus there’s strong potential for capital appreciation as the market grows.

Can first-time buyers invest in off-plan properties?

Absolutely! With milestone-based payment plans, first-time buyers can enter the market without paying the full amount upfront, making it much more manageable.

How do I minimize risk when buying off-plan?

Do your homework. Research the developer, check RERA approvals, and keep an eye on the project timelines to stay safe and secure your investment.

What are the best off-plan communities in Dubai for 2025?

Some top choices include Palm Jebel Ali, Emaar Grand Polo & Oasis, Dubai Island, Mina Rashid, and Maritime City. These areas are hot for both capital growth and rental demand.

How can Parklane Homes assist me in off-plan property investments?

Parklane Homes guides you through every step, offering access to prime projects, helping with payment plans, and giving strategies to maximize your ROI.

Conclusion & Next Steps

Off-plan properties in Dubai offer lucrative investment opportunities with capital appreciation, flexible payment plans, and high rental yields. By choosing reputable developers, conducting thorough research, and leveraging professional guidance from Parklane Homes, investors can secure profitable and safe investments.

Contact Parklane Homes today to explore Dubai’s top off-plan investment opportunities and maximize your ROI.